Last week, the Department of Labor succumbed to pressure from the financial industry and Congress by extending the comment period on a proposal to impose a fiduciary duty on brokers working with retirement accounts.

Despite the 15-day extension agreed upon by Labor Secretary Thomas Perez, many Wall Street figures remain unsatisfied.

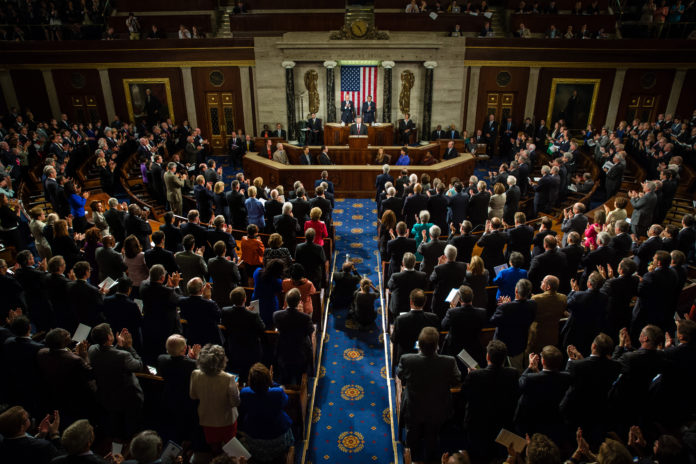

The initial proposal came last month, two months after President Barack Obama spoke in favor of the fiduciary standard at AARP Headquarters in Washington, D.C. At the time, the standard 75-day comment period was granted before the rule would be further considered. But after much lobbying from lawmakers and Wall Street executives, Secretary Perez finally acquiesced last week.

“This is considerably longer than the typical comment period,” Perez wrote as part of a note to Senator Jon Tester (D-MT). “We believe this accommodation will provide adequate time for the public to provide their input on this issue and for the administration to continue its dialogue with the stakeholder community.”

Senator Tester was part of a group of nine Senate Democrats who wrote to Secretary Perez earlier this month, asking for a longer extension—45 days, to be exact. These lawmakers maintained that the law is too complex for comment to be filed in 75 days.

With the extension, the comment period will last until July 21, rather than the previously agreed-upon deadline of July 6. The initial comment period will be followed by a public hearing during the week of August 10, where representatives from the Department of Labor and financial professionals will make their voices heard on proposed changes to the rule.

A revised version of the rule will then be presented for an additional comment period of 30-45 days. Even without any further delays, it’s now likely that the process will extend past election season in November and into the final year of president Obama’s administration. At least one supporter of the measure says that’s no accident.

“It’s pretty clear [the financial industry] is trying to delay [the rule] to kill it,” said Micah Hauptman, financial service council at the Consumer Federation of America.

Comments from Wall Street didn’t do anything to refute Hauptman’s claim. Despite receiving the extension they’d requested, financial professionals maintained they still would need more time to ponder the proposal.

“While we appreciate the extra two weeks, federal regulators should further extend the comment period,” lamented Francis Creighton, executive vice president for government relations at the Financial Services Roundtable.

In a situation that seems to get cloudier every day, one thing is crystal clear—if there is ever to be a fiduciary responsibility on Wall Street, it won’t happen without a lengthy fight from lobbyists and a small bit of cooperation from the financial industry.