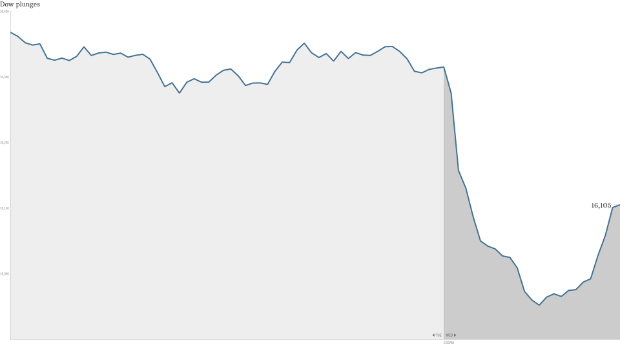

In recent days, the buzzword on the markets has been volatility. After today, there’s no getting around the truth—the market is in the midst of a full-fledged selloff.

It was an historic day for all the wrong reasons.

Wednesday Closing Bell

Dow Jones Industrial Average: 16,141.74 (-173.45)

S&P 500: 1862.49 (-15.21)

NASDAQ: 4215.32 (-11.85)

Among the lowlights:

- The NASDAQ index briefly crossed into correction territory (defined as a 10% reversal) before recovering some of its losses.

- 10-year Treasury rates dipped below 2% for the first time since May 2013, falling as low as 1.91% before closing at 2.09%.

- The Dow Jones Industrial Average moved a whopping 628 points in the first 30 minutes of trading today, the 5th consecutive daily drop. In those past five days, the Dow is down 5.02%.

The usual suspects—European struggles, Ebola virus concerns, and oil prices—were to blame for the awful session. A general lack of liquidity was the reasoning behind the early-morning ‘flash crash’ of 360 points. Stocks rallied considerably, only to fall back to session lows in the lunchtime hour, and break through to a new low (down 459 points) around 1 p.m. Eastern time.

Healthcare stocks were particularly hard-hit, in the midst of the ongoing Ebola virus scare. Moreover, airline stocks took a hit upon news that one of the healthcare workers infected with the virus was a flight passenger one day before receiving her positive diagnosis.

But despite the health scares, many investors insisted that Ebola was a ‘secondary’ concern; that the majority of the selloff was a result of continued struggles in the main European markets—each of which closed down 2% or more Wednesday. This was led by the Greek market, which was smashed to the tune of a 6.25% downturn. A double-whammy of political and economic woes created a perfect storm for a devastating day.

Add it all up, and you have each of the three major U.S. indexes circling closer to correction territory. Below are the percentages by which each index is off of its recent high. (Remember, 10% signifies a full correction.)

Dow Jones –6.59%

S&P 500 -7.48%

NASDAQ -7.81%