CNN-Money grabbed our attention with this headline recently:

The International Monetary Fund (IMF) has sharply cut its economic growth forecast for Saudi Arabia.

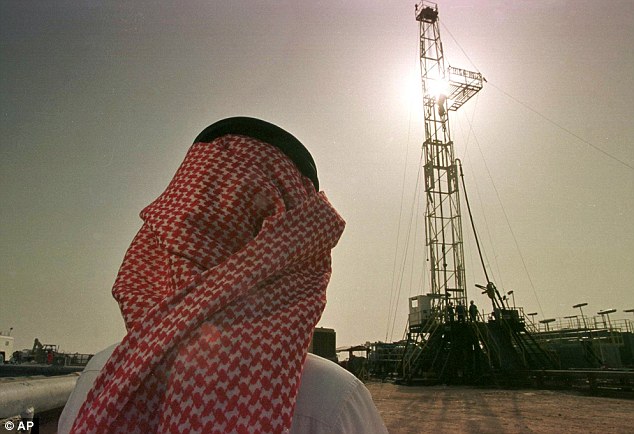

For years Saudi Arabia has been the world’s biggest exporter of oil, but now a severe budget crisis is forcing the oil rich nation to re-figure its finances. With no recovery in sight for the oil industry the IMF (which is an international organization of 189 countries working to secure greater global financial stability, promote high employment and sustainable economic growth, and reduce poverty around the world) expects the Saudi economy to grow only by 0.4% this year, down from a forecast of 2% just three months ago. This is due to a cut in oil production, thanks to the falling price of crude. Saudi Arabia and other major oil producers agreed to the cuts in December to ease the “over-load” of supply that had caused prices to collapse.

According to CNN.Money –

“The drop in oil prices has forced Saudi Arabia to rethink its economic strategy. The country’s budget deficit grew to $98 billion in 2015, and $85 billion in 2016, forcing the country to borrow money from international investors for the first time. The IMF expects Saudi Arabia to borrow more money in 2017. “

Saudi Arabia already cut energy subsides from its government, cut wages for officials and warned of 4 more years of austerity measures, which refers to official actions taken by the government, during a period of bad economic conditions, to reduce its budget deficit using a combination of spending cuts or tax hikes.

See more from CNN/money here.

Back in 2015 the prestigious think-tank; The Brooking’s Institution predicted Saudi Arabia was quote: “A ticking economic time bomb.”

So why should Saudi Arabia’s financial problems worry you if you’re in or near retired years? If Saudi Arabia’s economy starts to fail, then it destabilizes the Mideast region, and that economic tremor will have a domino effect on all of the other global economies connected to it; including the United States. The stock market is very volatile, and investors are likely to run scared if they see the energy sector starting to suffer because of Saudi Arabia’ increasing debt and financial troubles. if that happens, then you can expect a major correction of possibly a crash.