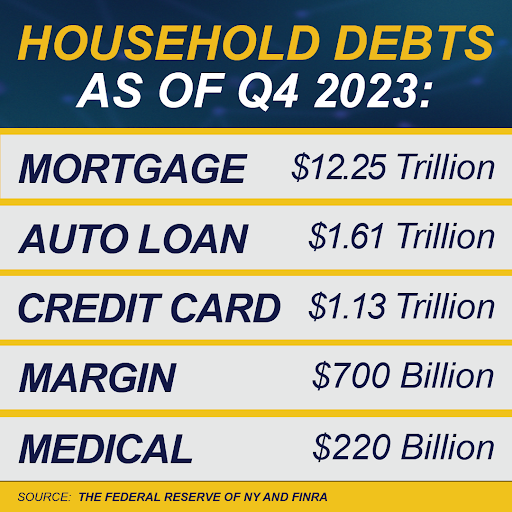

The United States is facing a growing crisis – a $100 trillion federal deficit and exploding debt totaling $17 trillion amongst everyday Americans. According to the most current data from The Federal Reserve Bank of New York and FINRA, mortgage debt has topped $12 trillion, credit card debt has surged over $1.13 trillion, auto loan debt tipped over $1.61 trillion, and medical and margin debt combined have reached almost $1 trillion.

Former Comptroller General David Walker, who served as the nation’s Chief Accountability Officer and head of the U.S. Government’s Accountability Office from 1998 – 2008, oversaw the government’s books, and provides unique insight as to the grave nature of the debt situation not just in our country, but around the globe: “There are too many countries, including our own, that have become addicted to spending deficits and debt. The global economy is increasingly interdependent and interconnected, but we have to recognize the reality – you can’t continue to spend more money than you make, charge to the credit card, make promises you can’t afford to keep, without someday having a day of reckoning.”

When I asked Walker whether the ‘day of reckoning’ predicted by many economists would have come sooner without the federal government’s massive stimulus programs conducted over the past decade, Walker responded affirmatively, noting, “I think so, yes… I think the federal government had to do something in order to prevent the collapse of the banking system, but now we’re in a situation where if we have another recession, the federal government doesn’t have any more tools in its toolbox.”

Echoing Walker’s sentiments is Andrew Huszar, the Federal Reserve employee who kicked off Quantitative Easing, which was the largest federal stimulus program in U.S. history back in 2008. Known as the “Quarterback of Quantitative Easing,” Huszar implemented the first wave of this policy, which involved purchasing $1.25 trillion worth of mortgage backed securities that had tanked the economy in 2008.

While Huszar initially saw the value in implementing Quantitative Easing, he later realized the negative impact of the stimulus program on the country’s debt and apologized to the American people. He explains, “I believe in Government, but I believe in smart Government, and I think what The Fed is doing – it’s just not smart Government. If you think of the U.S. economy as a business, we’re not dealing with our issues. We’re just kicking the can down the road and this is probably not going to end well in a number of different ways.”

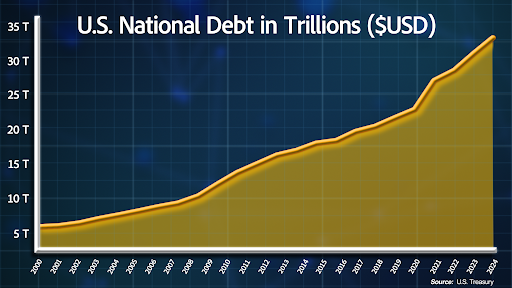

Both Huszar and Walker are students of history and understand that debt and deficits have been at the heart of every market crash known to man. For example, according to the IMF, leading up to the Great Depression, debt as a percentage of our GDP spiked from 23% in 1914 to 80% in 1932, and a Banking Collapse shortly followed in 1933. Today, our national debt is over $34 trillion – a whopping 124% of the United States’ GDP. Additionally, according to Walker, this statistic doesn’t account for the tens of trillions of dollars worth of unfunded entitlement programs, bringing that figure to north of $100 trillion.

Instead of addressing our nation’s debt, our federal government continues to compound the issue. Since January 2021, more than 2.5 million undocumented immigrants have crossed the southern border, accumulating to an estimate of over 12 million undocumented immigrants currently living on the nation’s already overstretched financial resources. The financial burden of healthcare, schools, law enforcement, and other public services, without the infusion of new tax dollars, will fall on legal residents and citizens through increased taxes. How long can the everyday American float these costs?

With the United States’ economy failing to produce the funds to pay government debts, taxpayers are taking on debt they can’t afford. Our government is adding expenditures on an already stressed system, so it is essential that we rethink fiscal and immigration policies to avert financial catastrophe. As history has proven: debt defaults lead to market crashes and depressions. Given the magnitude of the debt we’ve accumulated today, failure to address these issues will lead to financial turmoil that will crush Americans for generations to come.

– With All Truth