During his presidential campaign in 2024, Donald Trump made the imposition of tariffs a centerpiece of his policy proposals. These tariffs on countries like Canada, Mexico, China, and others would be intended to address trade deficits and get the United States on a path to recovering a domestic manufacturing economy that has steadily declined since the 1970s. During his first administration, Trump also used tariffs as a bargaining chip to convince neighboring countries to address issues like the influx of illegal immigrants at the southern border.

While protectionist trade policies like tariffs could be a solution to bring manufacturing jobs back to the U.S., they have also contributed to economic issues when implemented in the past. Trump himself has acknowledged the potential downsides of implementing tariffs, saying that Americans could feel “some pain” from a trade war with our largest trading partners, but also said in a recent social media post that it will “all be worth the price that must be paid.”

How much President Trump’s tariff war will help our economy remains to be seen, but it is certain to have an impact on American retirees and those who plan to retire in the next few years. The team at Crash Proof Retirement® has analyzed all potential consequences of the proposed tariffs to help you stay informed and make the best decisions regarding your retirement.

The Trump Administration’s Proposed Tariffs

Shortly after taking office, President Trump announced a plan to implement a tariff of 25% on nearly all imports from Canada to the United States with a lower 10% tariff on energy products, a 25% tariff on all Mexican imports, and a 10% tariff on Chinese imports. While these tariffs were set to take effect on February 4th, only the Chinese tariff was implemented on that date, with the rest being delayed until March 1st.

On February 10th, Trump made a social media post promising reciprocal tariffs across the board, meaning that any tariff placed on the United States would be met with a matching tariff on that country’s imports, in addition to 25% tariffs on all steel and aluminum coming into the U.S. Although these tariffs have yet to take shape, Trump administration officials did release a memo on potential reciprocal tariffs after his conversation with Indian Prime Minister Narendra Modi on February 13th. On February 19th, he also told reporters at Mar-a-Lago he is planning a tariff of 25% on all imported automobiles beginning on April 2nd, as well as a 25% tariff on pharmaceuticals and semiconductor chips that will “go substantially higher over the course of a year.”

While the status of these additional tariffs is currently up in the air, the Trump administration has already made sweeping changes at a rapid pace since his inauguration. With this in mind, it stands to reason that a global tariff plan could evolve rapidly and be implemented in the coming months. It’s also possible that these proposed tariffs are being used as a negotiation strategy, so the scope of goods being tariffed and the amounts of those tariffs are likely to change in the coming months.

Who Pays Tariffs?

Contrary to what many people believe, tariffs are not paid by the country on which they are imposed. Instead, a tariff is levied when goods are imported from those countries. That means that the person or entity who imported those goods will pay the tariff. When a U.S. automaker imports steel from a country affected by tariffs, for example, they will pay the tariff to the U.S. government. If they choose instead to use domestically manufactured steel, they will not have to pay the tariff. Although American companies have the option of absorbing the cost of tariffs, historically most have raised their prices to compensate, passing the cost on to the consumer.

Historical Impact of Tariffs

Early in American history, imposing tariffs was a good way to protect domestic industry and raise money for the U.S. Treasury. In fact, one of the first bills signed into law by Congress during its first session was the Tariff Act of 1789. In the absence of income taxes – which did not exist in the U.S. until 1913 – these tariffs were an important way for our fledgling country to raise revenue, by some estimates, tariffs provided as much as 95% of the federal government’s revenue at various periods in our history. While tariffs were never without controversy even in the 18th century, they did significantly contribute to the development of the United States.

By the 1900s, tariffs largely fell out of favor. With the industrial revolution heating up, American business owners felt they were being held back by having to pay tariffs on foreign imports, and domestic production of goods and raw materials was rising to a level where U.S. businesses no longer needed tariffs to protect them. The U.S. lowered tariffs in 1913, instead relying on income taxes to fund the government.

In the years after the end of World War I, some limited tariffs were reintroduced to protect American farmers who were in dire financial straits at that time. European producers, who had been put out of commission during the war, suddenly sprung back to life, leaving American farmers without a market to sell their crops. Despite agricultural tariffs introduced in 1922, American farmers continued to struggle. In the 1928 election, candidate Herbert Hoover promised higher tariffs, and after being elected, he began working on new protectionist trade policies for agriculture and a range of other industries.

Unfortunately for Hoover and the American people, the stock market crashed in 1929, kicking off the Great Depression. In 1930, the Smoot-Hawley Tariff Act was passed with the goal of helping American industry recover from the depression, but it had the opposite effect. The high tariffs imposed in the Act spurred a flurry of retaliatory tariffs from other countries. Suddenly, American businesses who were already struggling found themselves unable to sell their products in foreign markets. They were also paying higher prices for the imported raw materials they needed to operate, some of which could not be produced in the United States. During the period from 1929 to 1934 when the Smoot-Hawley Act was in place, global trade declined by nearly 66% overall. While there is much debate on this topic, most historians and economists agree that the tariffs imposed in 1930 and the ensuing trade war they created only served to deepen the severity of the Great Depression and lengthen its duration.

Will 2025 Be a Repeat of 1929?

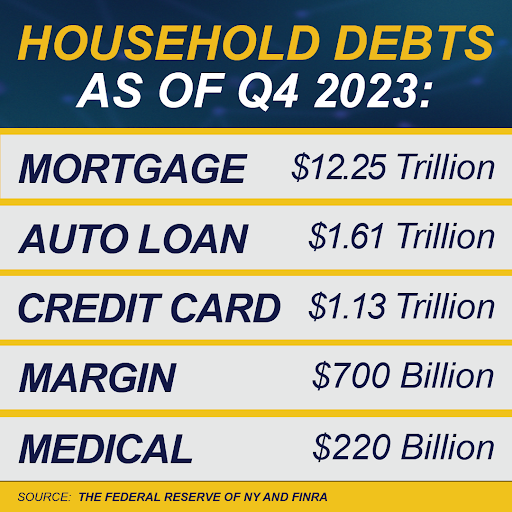

With many of the same conditions existing today as existed just prior to the Great Depression, many analysts have made a comparison between these two time periods. Today we see the same record-high stock market numbers and the same high inflation rates we saw in 1929. While the Federal Reserve’s policy of Quantitative Easing has propped up the stock market since the beginning of the COVID-19 pandemic, it could come crashing down at any time, bringing the value of your securities-based retirement portfolio with it. An extended trade war could be exactly what sets off that crash.

If the high tariffs the Trump administration has been teasing ultimately go into effect, Americans are likely to see higher prices on a range of goods and higher prices on services that rely on foreign imports. This could exacerbate already high inflation, making it harder for Americans to make ends meet. As always, retirees and those approaching retirement age will be the most vulnerable in this scenario.

Of course, a recession is far from a sure thing. We all hope that protectionist tariffs spur a resurgence of American manufacturing. While Americans are still likely to experience higher prices in the short term, a recovery of American manufacturing could bring prices back down and bolster the stock market.

Crash Proof Your Retirement Nest Egg

One benefit of moving your nest egg from risky, securities-based investments to the Proprietary Crash Proof Retirement® System is that you will stand to benefit no matter what the outcome of Donald Trump’s tariff measures may be. The financial vehicles used in the Exclusive Crash Proof Retirement® System are based in the financial life insurance industry, not the securities industry like stocks, bonds, and mutual funds. That means your nest egg will be protected from market crashes no matter what.

The Crash Proof Retirement® System also comes with built-in inflation fighters, which allow you to create additional income when you need it. If tariffs cause prices to increase, you can increase your income 35% or more so you can have additional income to cover increasing costs, without depleting your nest egg.

In addition to being resilient during economic downturns, Crash Proof® Vehicles have also been proven to achieve credited interest similar to the returns seen in securities-based investments when the economy is strong. Many Crash Proof® consumers have achieved double-digit returns, especially in the past year, and because the interest is credited annually, it becomes part of your principal investment and will also be protected from market crashes.

At the time of this article’s writing, many of these proposed tariffs have yet to materialize. We emphasize that the situation could change quickly and that you can rest assured we will follow up on this story as it unfolds. Check back with our blog for updates so you can stay informed about new tariffs and other developments so you can have all the information you need to make the right decisions about your retirement planning.

If you want to find out more about all the ways in which the one and only Crash Proof Retirement® System can benefit you, whether in times of economic uncertainty or in times of growth, schedule a financial checkup with the team at Crash Proof Retirement®. This checkup will be provided at no cost to you and comes with no obligation, so you have nothing to lose by calling us. Call 1-800-722-9728 to schedule your free consultation if you are looking for financial planners in Bucks County, PA, or anywhere else in the area.