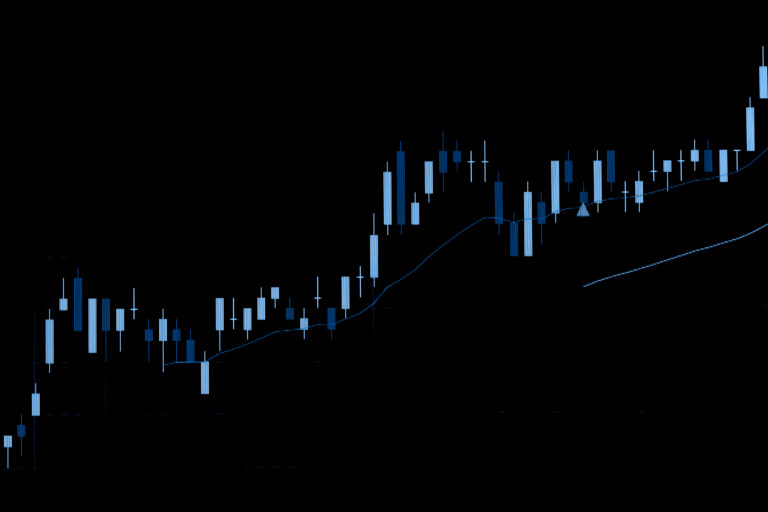

An increase in the number of jobs and a rise in the price of oil helped lift the markets today. The Dow closed at a 2 month high as it broke through the 17,000 barrier and the S&P 500 hit the 2,000 mark. For the week- oil finished up 9.5%. The February job’s report showed hiring was stronger than expected in February. There were 242,000 jobs added in February, far better than the 190,000 expected by economists. The unemployment rate remained steady at 4.9 percent. However hourly earnings fell by 3 cents to $25.35, after rising by 12 cents in January. Wages were up 2.2% which is weaker than the 2.5% gain in January.

The Volatility Index (VIX) which measures fear on the market fear, fell today to its lowest level this year, but what does that really mean? Watch below.

Here are the final numbers from Friday, 3/4/16 on Wall Street

Dow Jones Industrial Average: 17,006.77 (+62.87 / +0.37 %)

NASDAQ: 4,717.02 (+9.60 / +0.20 %)

S&P 500: 1,999.99 (+6.59 / +0.33 %)