Today, the American public is focused on the mid-term elections—and rightfully so. All 435 seats in the U.S. House of Representatives are up for grabs, as are one-third of Senate seats. In addition, 36 of 50 states will have their governorships determined Tuesday.

These elections will go a long way towards determining the direction of Barack Obama’s last two years in office, and as always that outcome will be reflected by the stock market.

The biggest mystery surrounding Election Day is the makeup of the United States Senate. The Democratic Party currently enjoys a 53-45 majority in this branch, plus two Independent members who caucus with the Democrats and are therefore considered a part of the majority. That means that out of the 33 seats contested next week, the Republicans need to take six additional Senate seats to enjoy control of both branches of Congress (the Republicans already hold a 33-seat majority in the House, which they are widely expected to maintain after the elections.)

Why is this significant? The last three two-term presidents (Ronald Reagan, Bill Clinton, George W. Bush) both presided over similar disbursements of Congress—meaning the controlling party was opposite of their own. Most troubling of all, however, is that all three Presidents oversaw significant downturns or stagnation in the market during those final two years in office.

Why? Explanations are numerous. It’s obviously harder to get anything accomplished in Washington, D.C. when the legislative and executive branches are in direct conflict. Some believe this is only compounded when an outgoing President is in his last two years, no longer concerned with running for re-election and instead focused on cementing his legacy.

Whatever the case, as the old saying goes—“once is an accident, twice is a coincidence… three times is a trend.” (or pattern, or proof.) Retirement Media Inc. looked at these three Presidents, their last two years in office and the surrounding conditions that may have determined market direction during those times.

Ronald Reagan: President from 1981-1989 (Party: Republican)

Controlling Party of Congress for last two years: Democratic (55-45 Senate; 258-177 House)

Market Summary: On the surface, the Dow Jones numbers look pretty appealing to investors: almost 15% in gains over the last two years of the Reagan era. However, consider the following:

- In Reagan’s first six years, the Dow Jones Average nearly doubled (from 950 on Inauguration Day 1981 to 1,877 on Election Day 1986.) By comparison, a 14.8% return over the final two years appears rather paltry.

- That initial pace of growth may well have been sustained if not for the most catastrophic single event in Wall Street history since the Great Depression—Black Monday, chronologically known as October 19, 1987. On that single day, the Dow shed almost a quarter of its total value, dropping 508 points during the session. From its August 25, 1987 high of 2,722; the Dow dropped almost 1,000 points to 1,738 by the end of Black Monday—a drop of over 36% in less than two months!

- Needless to say, Black Monday scared plenty of investors off the markets altogether—it was an event that was literally unprecedented in many of their lifetimes. These people had seen many of their Reagan Era gains wiped out in a single day—and as a result, were not on the market to participate in the recovery. On Wall Street, sometimes all it takes is one bad day.

Bill Clinton: President from 1993-2001 (Party: Democratic)

Controlling Party of Congress for last two years: Republican (55-45 Senate; 223-211 House)

Summary: There’s no questioning that President Clinton oversaw the greatest eight-year run in stock market history. From his 1993 inauguration until the end of his term, the Dow Jones Average more than tripled, growing from 3,241 to almost 11,000. Again, however, the momentum began to slow towards the end of his term. If you experienced 169% growth in a six-year period, a figure like 24% growth in the ensuing two years might leave you feeling a bit underwhelmed.

But imagine the reaction of people who lived through the Great Depression if they heard complaints about money only growing 24% in two years! Therefore, let’s focus on the events during those last two years that led to the early 2000s recession. This downturn is typically known as the Crash of 2001-2002—however, the reality is that it began in 1999 and 2000, the final years of Clinton’s administration.

A stock market bubble occurs when a rise in stock prices is created by a factor that is only tangentially related to the economy overall. Many companies, as a result, become greatly overvalued. Unfortunately, it’s often hard to identify a ‘bubble’ until it’s already burst. This was the case with the dot-com bubble, which started in the mid-late 1990s as startup companies took advantage of low interest rates to attain skyrocketing amounts of capital.

Through 1999 and early 2000, the Federal Reserve increased interest rates six times. The easy money dried up, and the bubble burst on March 10, 2000. The day before, the NASDAQ index had reached its all-time high (5,048.62). Nine days later, the index had declined more than 10% off of its high.

Meanwhile, the Dow Jones Average had attained an all-time high of 11,722.98 on January 14, 2000. But investors must have sensed trouble, as the market had dropped a full 20% by March 8, 2000—two days before the dot-com bubble burst.

The rest, as they say, is history. The stage was set for a bear market that would last more than three years. From that January 2000 high of 11,722.98, the Dow would fall as low 7524.06 by March 2003—a crash of 36%. And it all started with the dot-com bubble of the mid-late 1990s.

George W. Bush: President from 2001-2009 (Party: Republican)

Controlling Party of Congress for last two years: Democratic (51-49 Senate; 236-199 House)

Summary: President Bush’s administration ushered in the new era of stock market volatility. He took office at the start of the early 2000s Crash, guiding the country through the tragic events of 9/11 in the first year of his term—then enjoyed several prosperous years from 2003-2007. But the worst, as we all know, was just around the corner.

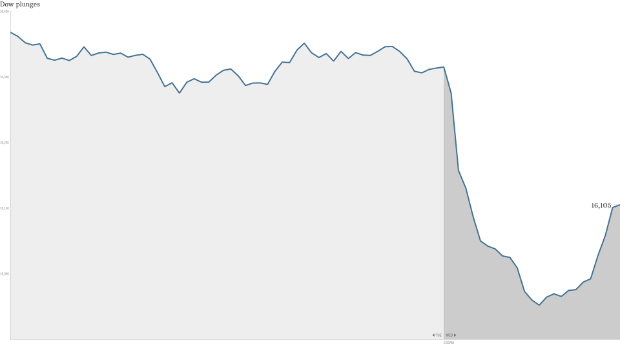

No one needs much of a refresher of the Great Recession, but here are the numbers: from a high of 14,164.53 on October 9, 2007, the Dow Jones Average would lose a staggering 54% of its value over the next 17 months, not bottoming out until it reached 6,547 on March 9, 2009—two months after President Bush had left office. The S&P 500 declined slightly more, a loss of 57% over the same time period.

When all was said and done, the United States had seen the worst financial crisis since the Great Depression.

Will President Obama be able to avoid this disturbing trend? He’s facing the same obstacles as his three predecessors:

- He’s in the last two years of his administration

- The market has been quite prosperous for most or all of his presidency

- The House has a clear majority of Republicans, while Obama is Democratic

All that’s left to determine is the Senate. Tuesday could tell us a lot about the market direction of the next two years.