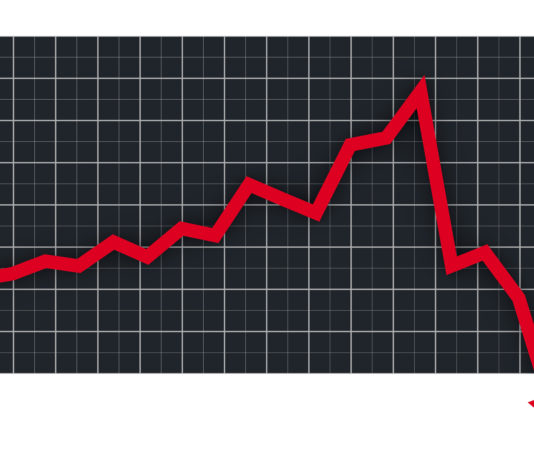

U.S markets opened the final week of September 2015 with a nervous level of uncertainty on the ambiguity of a possible future rate hike by the Fed, along with more worries about the global economy. The S&P 500 dropped over 2.4%, falling below the emotionally important level of 1,900...

U.S. stock futures were close to even Tuesday, following another disappointing day for equities on Monday.

Monday's session pushed the Dow Jones Average into the red for 2015, and continued what’s becoming a troubling string of losses on the market. 10 of the last 14 sessions have seen the major...

Markets were up today as JP Morgan's earnings beat Wall Street's predictions and an overseas rally in China followed some encouraging trade data. The Dow closed at a 5 month high and financial stocks led the way.

Terry Sandven, chief equity strategist at U.S. Bank Wealth Management explained today's rally...

Stocks closed down again today on the final trading day of the week and a headline on CNBC today got a lot of people's attention.

"World economy seems trapped in 'death spiral."-according to Citigroup

According to CNBC:

Some analysts — including those at Citi — have turned bearish on the world economy...

The markets spent the entire week following the news from Greece—and as the Greek government and European officials struggled to reach a deal, U.S. markets turned in a sub-par performance. As a result, the Dow stands at just +0.7% for the year, with Tuesday marking the halfway point of...

The positive feelings on Wall Street were wiped out in a mere hour this morning, as stock prices tumbled in the wake of a double-dip of bad news.

At one point, the Dow was down 130 points for the day. Prices made some recovery before the close of business, but...

U.S. stock futures were lower Thursday, as investors turned a wary eye towards rising 10-year Treasury yields.

Yields move in the opposite direction of the bond’s price, so it was alarming when the European trade market saw bonds exceed 2.4 percent—the highest mark in 2015. The volatility seen in the...

The Federal Open Market Committee (FOMC) concluded its two day series of meetings with a decision not to raise interest rates. Wall Street's major averages extended gains as the close approached, more than recovering from a brief dip into negative territory after the release of the Fed statement. The...

As word leaked out late yesterday afternoon that the Federal Reserve will be requiring U.S. banks to consider the idea of how they theoretically could handle a "negative interest rate" scenario, Fed Chair Janet Yellen told a congressional hearing today that "the central bank has not completely researched whether...

U.S. stocks were higher Tuesday, as investors turned away from concerns over the Greek credit crisis and looked toward tomorrow’s Fed meeting minutes.

The Dow regained much of its’ 107-point loss from Monday, as European equities stabilized amidst the ongoing controversy over Greece’s bailout conditions. The Greeks have a 1.7...