It was the start of a monumentally important week on Wall Street as the Fed will consider whether to raise interest rates midweek. It is widely expected that after the Federal Reserve's Open Market Committee's two day meeting on Wednesday, the Fed will decide to raise interest rates by...

On the day prior to the start of the Federal Open Market Committee's two day series of meetings to decide whether to raise interest rates, stocks saw gains across the board. The rise was helped in part by the stabilization of the price of oil which settled up $1.04,...

As was expected The Federal Open Market Committee today approved a quarter-point increase in its target funds rate. The new target will go from 0 percent to 0.25 percent to 0.25 percent to 0.5 percent. The Federal Funds Rate has remained at zero for the last 7 years to...

A day after the Fed decided to raise interest rates a quarter of a percent for the first time in a decade, the volatile price of oil along with the energy sector caused the markets to drop today. Energy finished down 2.5% to lead nearly all S&P 500 sectors...

The last session of the trading week saw the 2nd consecutive day of big losses on Wall Street as investors struggled with oil and economic data in the aftermath of the Federal Reserve's rate hike Wednesday. The Dow dropped over 370 points while the NASDAQ fell below 5,000. Ben...

The Christmas shortened trading week on Wall Street began on an up note as the markets tried to stave off the massive losing streak from last week. Both the S&P 500 and Dow Jones industrial average are still negative year-to-date, down more than 1.5 percent and 3 percent. The...

"I just think people are bottom-fishing here" -James Meyer, chief investment officer at Tower Bridge Advisors

And thus was one investor's opinion of what happened on Wall Street on Tuesday. Markets experienced a 2nd straight day of gains as the S&P added 1%, oil stabilized and Caterpillar (one...

On the last day of a Christmas shortened trading week, Wall Street picked up some gains and the energy sector bounced back, although according to Market Watch reporter Anora Mahmudova, the Santa rally can’t fix the real problems plaguing stocks. Check it out here.

The Dow was up by as...

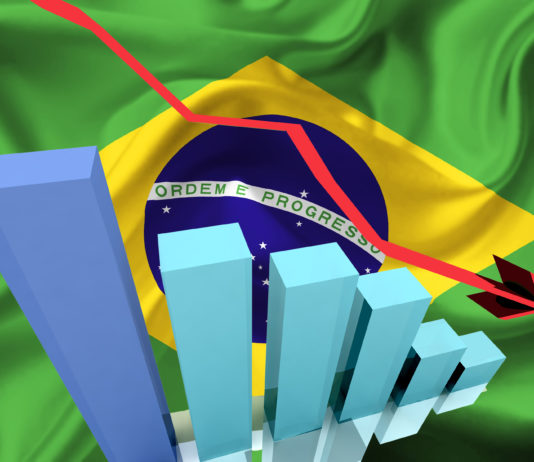

On the first trading day of 2016 Wall Street experienced huge losses as the financial world reacted to continued economic instability in China. Earlier, the Dow fell more than 450 points, plummeting more than 2.5 percent, on pace for its largest percent decline on the first trading day of...

Following Monday's massive selloff, Wall Street went into the second trading day of 2016, attempting to regain some of the losses from the day prior. Investors wavered for much of the day before finishing with a mixed session. Apple stocks led decliners falling over 2% at one point following...