Rising oil prices highlighted the first day of the new trading week as investors awaited the results of new sales data expected by the end of the week. The markets began the day with the S&P 500 and NASDAQ at new, all-time high record levels.

More from CNBC below.

Oil rose...

A better than expected July jobs report helped vault the markets into higher territory today. The U.S. economy added 255,000 jobs in July, well above the expected 180,000. The unemployment rate remained unchanged at 4.9% but today's unemployment report sent stocks on major upswing with the S&P 500 &...

Ahead of Friday's U.S. jobs report, today the Bank of England cut interest rates in the U.K. to avoid a possible post-Brexit vote recession. Policymakers voted unanimously to cut rates a quarter point to 0.25% in the BOE's first rate reduction in seven years. Banking officials in the UK...

Investors continued to appear nervous as stocks barely held their own today. The market avoided its 8th straight day of losses. Prior to yesterday's setback the Dow's last 7 day losing streak was a year ago in August of 2015. Oil recovered some today, gaining $1.32 and closing above...

Falling oil prices put a drag on the stock market for the first day of August. Oil prices closed 3.7% lower at $40.06 per barrel after briefly dropping below $40. The big topic over the weekend was whether the Glass-Steagall Act should be brought back and if so, what...

This was the worst week for the Dow Jones Industrial average in over a month as its 4 weeks winning streak ended. For the week the Dow lost 143 points. The latest readings on American Gross Domestic Product for the 2nd quarter of 2016 show the GDP fell below...

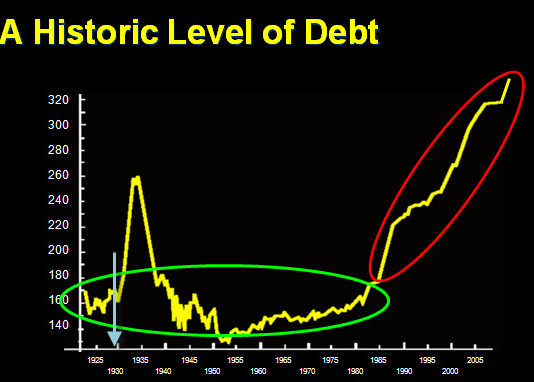

As the price of oil hit a 3 month low & Facebook stock hit an all-time high, the big story to hit the financial headlines today was an interview that appeared on CNBC with Terry Chan-head of S&P Global Ratings Analytical Research. The focus was on corporate debt and...

The Federal Open Market Committee has opted against raising the federal funds rate for July. As expected, the FOMC kept its overnight interest rate at 0.25 percent despite signs that the labor market has gotten stronger along with other signs indicating growth.

According to the Fed statement released today:

"Job gains...

After a four week winning streak the markets are now down in each of the first two sessions of the week after a mixed today Tuesday. Dow components led decliners with telecom issues and McDonalds leading the slide. The fast food giant fell 4.5% after reporting lower than expected...

Coinciding with the start of the DNC in Philadelphia, stocks kicked off the week on a down note as oil prices slid. The price of a barrel of oil closed at its lowest level since April 25th over worries over a global "over-supply." U.S. crude settled down $1.06, or...