What’s the worst month for the stock market historically?

Most people (including myself) probably would’ve guessed October. For example, I knew the Great Depression was highlighted by a late-October tumble in stock prices back in 1929. I know that “Black Monday” occurred in October of 1987. And I remember October...

We're only a week into August, but it’s already a month that will go down in infamy at Bank of America.

The firm agreed temporarily this week to a record-setting $16-17 billion settlement over mortgage misconduct in the build-up to the 2008 financial crisis. This projected settlement comes on the...

It’s been almost four years since the Department of Labor (DOL) proposed a rule that would enforce a fiduciary duty on financial advisors who work with retirement accounts.

But little progress has been made towards imposing such a standard, thanks to continued protests from the financial industry. The most recent—and...

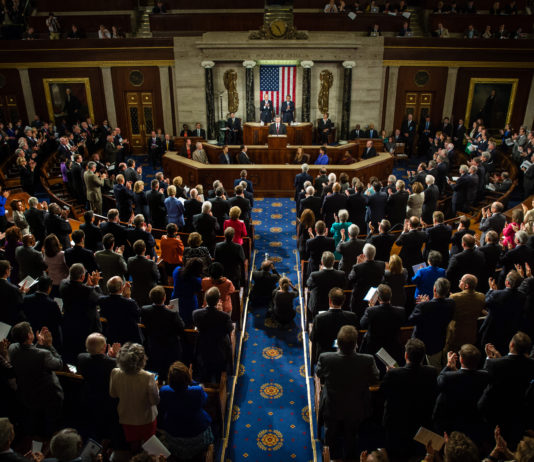

The long debate over conflicts of interest on Wall Street will reach its boiling point this week, when the Department of Labor (DOL) hosts numerous hearings over the proposed fiduciary rule.

All sessions will be conducted at DOL headquarters in Washington, D.C., and will feature numerous participants representing opposing sides...

Stocks stayed even in Wednesday trading, after a volatile Tuesday saw the Dow drop almost 200 points before rallying to finish the day flat.

Investors are anxiously awaiting word from the European Central Bank (ECB) as to whether they will embark on a long-expected bond buying program. ECB President Mario...

Last week, the Department of Labor succumbed to pressure from the financial industry and Congress by extending the comment period on a proposal to impose a fiduciary duty on brokers working with retirement accounts.

Despite the 15-day extension agreed upon by Labor Secretary Thomas Perez, many Wall Street figures remain...

U.S. stock futures finished slightly up on Monday, extending yet another on both the Dow and the S&P 500.

Despite the continuation of disappointing economic data from the first quarter of 2015 into the second quarter, the market has moved higher in the past few weeks. Highlighted by S&P 500...

It was a relatively flat day on Wall Street, with small gains as markets struggled to gain any momentum following release of the July Fed minutes. General consensus from voting policymakers is that that more data is needed before another Fed rate hike is considered. Read the July Fed...

Stocks showed gains on the second trading day of the week despite the fact that the U.S. manufacturing sector contracted in November, dropping to its worst levels in over 6 years when the American economy was still in the middle of a debilitating recession. The latest report by the...

It’s been nearly a month since President Obama made a strong push for fiduciary responsibility on Wall Street, explaining that biased financial advice robs everyday Americans of billions of dollars each year.

Since that time, politicians and financial advisors alike have weighed in on the issue. But on Tuesday, perhaps...