This week’s approval of H.R. 83, the $1.1 trillion ‘Cromnibus’ spending bill that will fund the federal government for 2015, did serious damage to the Dodd-Frank Act.

Language in the bill re-permits trading in swaps and derivatives by FDIC-insured banks—a practice the Dodd-Frank Act eliminated when it was signed back in 2010.

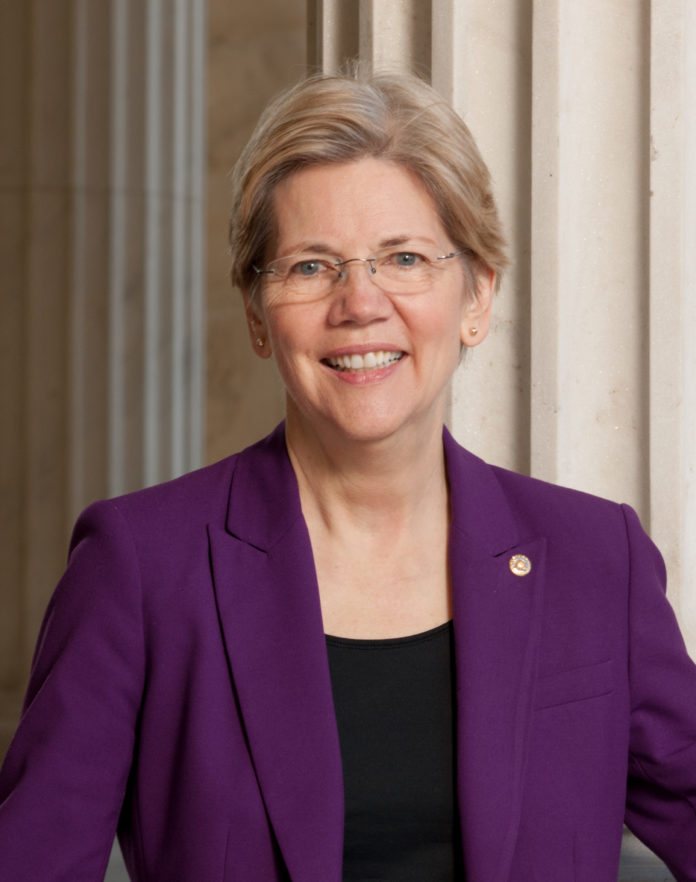

But in the hours leading up to the bill’s approval, Senator Elizabeth Warren (D-MA) saw to it that everyone on the Senate floor knew exactly who was responsible for eradicating the financial reforms the Dodd-Frank sought to ensure.

“In recent years, many Wall Street institutions have exerted extraordinary influence in Washington’s corridors of power,” Sen. Warren told her colleagues.

Senator Warren singled out Citigroup individually, referencing the ‘revolving door’ that has seen many Citigroup executives take prestigious positions on Capitol Hill—or vice versa. Warren said that these former bankers are notorious for lobbying in favor of Wall Street-friendly policies upon reaching Washington, D.C.

Click Player Above to Watch Phil Cannella Interview the SEC Inspector General about the Revolving Door

“There’s a lot of talk coming from Citigroup about how Dodd-Frank isn’t perfect,” said Senator Warren. “Let me say this to anyone who is listening at Citi: I agree with you. Dodd-Frank isn’t perfect—it should have broken you into pieces.”

The almost-immediate impact of Warren’s speech can’t be denied. As of Friday morning, the speech had garnered almost 570,000 views on You Tube, and received accolades from publications such as The Huffington Post, who called the 10-minute diatribe “the speech that could make Elizabeth Warren the next President of the United States.”

“[The speech] catapulted Warren from a potential nuisance to Hillary Clinton’s coronation as the Democratic nominee to someone who could foreseeably win the nomination and even the Presidency,” wrote Miles Mogulescu of The Huffington Post.

Warren’s passion reached Citigroup in a literal sense on Thursday, when a group of protestors gathered near the financial giant’s Manhattan headquarters, wielding signs with slogans such as “Break Up The Big Banks” or “No More Too Big To Fail.”

Big banks have been in Senator Warren’s crosshairs since 2008, when she took office in the aftermath of the financial crisis that ravaged many a retirement account. The crisis and collapse of several financial institutions began with risky derivative bets—the same taxpayer-backed gambles that the ‘Cromnibus’ bill re-legislated this week.

For their part, Citigroup executives and investors expressed little concern over Senator Warren’s statements, attributing the remarks to her own political ambitions. But if those ambitions include a run for the White House in 2016, big banks and Wall Street in general might look quite different in the next several years.