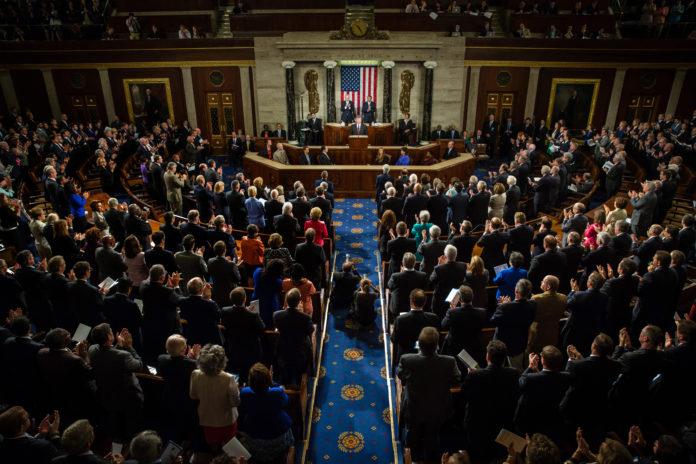

In less than two weeks on the job, the 114th United States Congress has taken major steps towards undoing one of the most important pieces of financial legislation this decade.

Rep. Mike Fitzpatrick (R-PA) is a member of the House Financial Services Committee. Last week, Rep. Fitzpatrick introduced a bill called the Promoting Job Creation and Reducing Small Business Burdens Act., or H.R. 37. The bill narrowly missed ratification through a fast-track vote last week, meaning it would have to go through typical legislative procedure before being enacted into law.

Only then was the public able to see this proposed law—presented as a boost to the job market—for what it really was. If approved, H.R. 37 would permit and extend the same risky Wall Street behavior that sent this country spiraling into the Great Recession seven years ago. It would accomplish this by repealing or restricting important provisions of the Dodd-Frank Act, which brought sweeping changes to financial regulation back in 2010.

H.R. 37 would undo the following Dodd-Frank rulings:

Banks Dealing in Risky Securities: The Volcker Rule was one of the crowning achievements of the Dodd-Frank Act. Among other provisions, the Volcker Rule mandated that federally-insured banks would be unable to participate in risky, speculative trades.

When Dodd-Frank was initially signed into law, it was agreed that banks had five years—until the year 2015—to free themselves from these risky investments. Last spring, the Federal Reserve agreed to extend that deadline to 2017.

Now, H.R. 37 proposes adding another two years to that deadline. If approved, that would mean major investment banks could potentially hold onto these risky investments for a full decade after being ordered to sell.

Private Equity Firms: A second condition of H.R. 37 deals with the loosely-regulated private equity industry. It states that certain private equity firms would not be required to register with the Securities and Exchange Commission (SEC) as brokerage firms.

Securities law dictates that institutions who receive fees for investment banking activities must be formally registered as brokerage firms. Brokerage firms are subject to more frequent, more stringent examinations from regulatory bodies. Brokers and their firms, of course, would love to avoid any added scrutiny if possible—even though experts believe such inspections could aid in avoiding conflicts of interest that can impact investors’ portfolios.

Derivatives Trading: Maybe the most frightening condition of H.R. 37—for those worried about another financial collapse—is the item that would allow Wall Street firms to resume trading derivatives privately. This was the very activity that received considerable blame for the 2007-2008 recession.

Transparent trading—performed through clearinghouses—allows for proper risk management and elicits accurate price information on derivative swaps. This makes it easier for regulators to evaluate a bank’s exposure to risk via derivatives. If H.R. 37 goes through, banks will be able to resume their preferred method of trading away from the watchful eyes of regulatory officials.

In 2011, I invited Rep. Fitzpatrick to be a guest on the Crash Proof Retirement Show, which is a production of Retirement Media, Inc. Here is part of that exclusive interview:

Unfortunately, that offer was a hollow one because we never participated in such a hearing. As the face of H.R. 37, it seems that Fitzpatrick’s tune has changed. And that sickens me.

December’s well-publicized Cromnibus spending bill was a small victory for Wall Street brokers opposed to increased regulation. Should H.R. 37 pass, they’ll be celebrating an even bigger triumph. For the American taxpayer, however, H.R. 37 represents a significant setback in the quest for transparency.