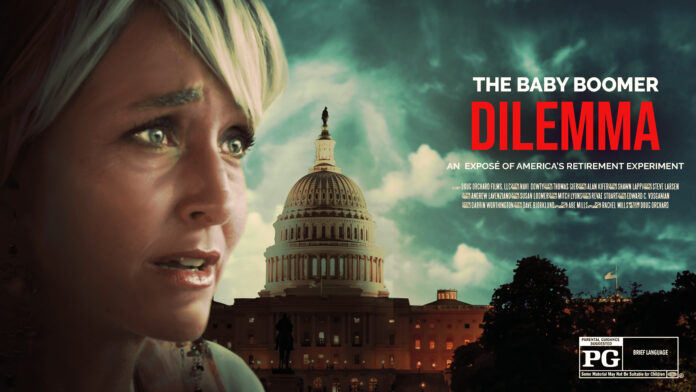

A documentary film has been sweeping the nation, revolutionizing the way investors are looking at retirement planning. “The Baby Boomer Dilemma: An Exposé on America’s Retirement Experiment” takes a deep dive into the lethal pitfalls of the retirement savings plans that all consumer investors were told were safe, while experts and advisors alike never exposed the true alternative solutions that lie outside of Wall Street and lead to a guaranteed retirement future.

Throughout the movie, award-winning director Doug Orchard uses exclusive interviews with an army of the highest level experts in the financial industry such as the “father of the 401(k)” Ted Benna, who was hired to create the 401(k) back in the ‘80s, two world renowned Nobel Prize winners, and six distinguished Ph.D. economists from the top business schools, to expose the devastating cracks in the financial industry that have 401(k)s, IRAs, Social Security, and other retirement plans on the brink of collapse.

An important message in this movie is the need for dependable guaranteed income streams that provide inflation fighters in retirement. One of the distinguished experts in the film, Moshe A. Milevsky, impressively earned a Ph.D. in business finance and a master’s degree in mathematics, and has been a professor at York University for 25 years. Milevsky takes the time to put the spotlight on widely known investments that most people invest in, like stocks, bonds, and mutual funds, saying they are, “nothing more than one big lump sum of money.”

Milevsky is pointing out that, it doesn’t matter if you’re in stocks, bonds, mutual funds, or 401(k)s, advisors and experts alike will tell you you’re diversified with Wall Street, but they’re all in the same category – “one big lump sum of money” – risk investments. As most experts agree, you cannot have a guaranteed retirement future made up of a lump sum of risk investments.

Edward Siedle is one of the most experienced former SEC attorneys and earned the SEC’s largest whistle-blower award. In the film, he sheds light on the truth about the hidden fees that compound the risk all Wall Street investors face. Siedle points out and cautions,

“How much do 401(k)s lose when they pay excessive mutual fund fees? The answer is that half a percent or more a year in excessive fees causes your average American worker to have maybe 60% of what they would’ve.”

One would have to ask, with the hidden ongoing fees in securities and mutual funds and the lump sum of risk most financial portfolios are made up of, how can the everyday investor have a guaranteed retirement future? Sadly, the responsibility is left to the people who know the least about investing – the everyday investing consumer.

Moviegoers will learn what all the experts in the film, and around the globe, tout as the best way to find the guaranteed income streams that so many Baby Boomers are missing: investments from the financial life insurance industry. These alternative investments, called fixed index annuities (FIAs), offer guaranteed income that is tax-deferred, with no risk of market loss. As Milevsky explains, this consensus among economists is a rarity in the financial industry.

He says, “There seems to be only one area in economics where there’s almost consensus. Almost all economists, no matter what model or frame of mind they’re coming to the retirement dilemma with, they’ll say it’s a good idea to take a part of your nest egg at retirement and buy a guaranteed source of income otherwise known as an annuity.”

The film’s most renowned expert, the late Dr. David Babbel, established himself as an elite Ph.D. economist after over a decade of rigorous training to earn his Ph.D., followed by a 25-year career teaching at the top business school in the country, the Wharton School of Business, which has held that number one spot since the school was founded in 1881.

In 2009, the great Dr. Babbel and a team of six of Wharton’s top Ph.D. economists and two senior actuaries conducted a two-year in-depth study on FIAs titled “Real World Index Annuity Returns.”

Dr. Babbel is quoted in the conclusion of his team’s study saying, “Since their inception in 1995, FIAs have outperformed corporate and government bonds, equity mutual funds, and money markets in any combination, not just one year, but every year through the study’s completion (Which includes enduring the market crashes of 2001 and 2008).”

The conclusion of this study prompted this prominent economist, Dr. Babbel, to invest his own hard-earned savings into 14 FIAs of his own. He shares how important the FIAs that he researched are and explains the benefits he experienced for himself by saying in the film, “If you’re a good manager of your money, you shouldn’t get one annuity – you should get several. You get enough to live off of to get your basic income and that’ll get you through maybe 70 to 75. Then when you start running short of money, you have these other annuities that are growing tax-deferred.”

Dr. Babbel goes on to explain a strategy called staggered annuitization in which he activated only seven of his 14 annuities when he retired, while the other seven were there for him to be activated as a guaranteed income stream when needed. While those accounts weren’t activated, they accrued interest, and provided market-like returns without market risk.

He provides an example of how this staggered annuitization works by saying, “When my wife says, ‘Dear we need some more money,’ I say, ‘I have got a deal for you.’ And I turn on one of the annuities and woah, it increases our income by 25 to 30 percent for the rest of our lives.” After conducting thorough research and experiencing the benefits of these FIAs himself, we were surprised that he declined an invitation to discuss these investments on The Crash Proof Retirement® Radio Show back in 2011, and why he wasn’t sharing his research with the American Retiree elsewhere.

The truth is, there was a conflict of interest. Companies like Goldman Sachs, survive and thrive selling risky Wall Street investments and don’t promote the safe alternatives that the best economists, including Dr. Babbel, know will guarantee a retiree’s future and income.

Therefore, when economists graduate from globally respected universities like Dr. Babbel did, investment banks like Goldman Sachs swoop in, snatch them up, and put these recognized economists on their payroll through different boards. In Dr. Babbel’s case, Goldman Sachs appointed him the founder and leader of their Pension and Insurance Department.

When Dr. Babbel was placed on Goldman Sachs’ payroll, a conflict of interest was created thus explaining why Dr. Babbel was unwilling to spread the truth about the investments he knew to be successful for himself and his family.

Only when Dr. Babbel became terminally ill did he feel free of his conflict of interest with Goldman Sachs and agree to disclose how he invested his own life savings in investments that aren’t sold by Goldman Sachs – FIAs.

Dr. Babbel lost his battle with leukemia in May 2021, just shy of the film’s release date. Knowing the severity of his illness, he pushed through production to leave a financial legacy by alerting the American public to the safe alternatives from the financial life insurance industry that guarantee his family and over 5,000 Crash Proof® consumers the guaranteed income, the principal protection, and the growth they need to guarantee their current lifestyle through retirement years.

Crash Proof Retirement® would like to thank Dr. Babbel for the long-term relationship and for being a consumer advocate for the everyday investor, exposing these exceptional vehicles that came out in 1995, in this must-see documentary. Crash Proof Retirement® urges you to reserve your seat for one of Crash Proof Retirement®’s complimentary private showings of “The Baby Boomer Dilemma.” Seating is limited and registration is required. Call 800-722-9728 or visit crashproofretirement.com to reserve your seat.