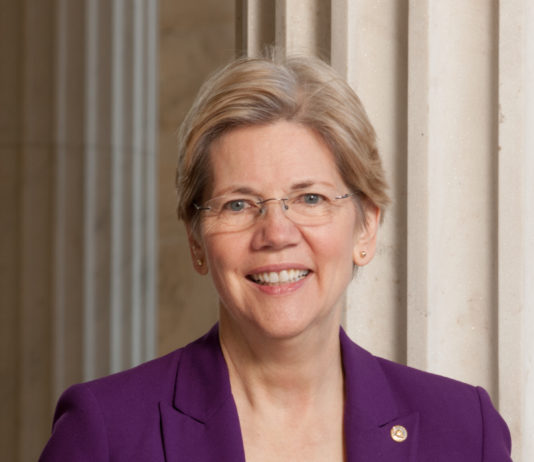

This morning, the Senate will hold a hearing on the topic of regulatory capture—a term used to describe the often-observed tendency of government officials to become a little too close to the institutions they’re supposed to be regulating.

The impending case made yesterday’s announcement from the Federal Reserve all the...

Wall Street has plenty to be thankful for this Thanksgiving. Stocks continue to break records, even as the recent rally slows considerably. On Monday, the S&P 500 broke its all-time high for the 43rd time in 2014.

But Tuesday morning’s economic reports cast a cloud over the market. The good...

A recent study conducted by Wells Fargo illustrates just how nervous—and unprepared—the everyday American is for retirement.

In the Wells Fargo Middle Class Retirement Survey, some 22 percent of middle-class Americans indicated that they would prefer to ‘die early’ over living well into retirement without the means to preserve their...

The continued fall of oil prices was the big story on the markets this week. It was Wall Street’s worst week of 2014, and the Dow’s worst week in three years, as it dropped 683 points!! Lower gasoline prices may be keeping more money in your pockets, but oil...

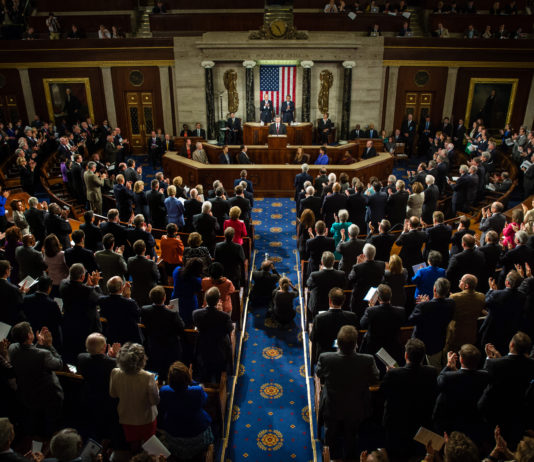

This week’s approval of H.R. 83, the $1.1 trillion ‘Cromnibus’ spending bill that will fund the federal government for 2015, did serious damage to the Dodd-Frank Act.

Language in the bill re-permits trading in swaps and derivatives by FDIC-insured banks—a practice the Dodd-Frank Act eliminated when it was signed back...

The crisis in Russia worsened Tuesday when Standard and Poor’s (S&P) placed the nation on negative credit watch.

In a statement, S&P said that the move “stems from what we view as a rapid deterioration of Russia’s monetary flexibility and the impact of the weakening economy on its financial system.”

The...

2014 was another historical year for Wall Street. The blue-chip Dow Jones Industrial Index reached its all-time high 37 times, while the broader S&P 500 reached a new apex on a whopping 52 occasions!

So it might surprise you to learn that it was actually a below-average year for the...

In less than two weeks on the job, the 114th United States Congress has taken major steps towards undoing one of the most important pieces of financial legislation this decade.

Rep. Mike Fitzpatrick (R-PA) is a member of the House Financial Services Committee. Last week, Rep. Fitzpatrick introduced a bill...

The concept of diminishing returns is one of the oldest tenets of economics. It states that if one factor in production is continually increased while all others remain stable, the results of that production will become smaller and smaller.

The United States realized this during its three separate quantitative easing...

It’s been almost four years since the Department of Labor (DOL) proposed a rule that would enforce a fiduciary duty on financial advisors who work with retirement accounts.

But little progress has been made towards imposing such a standard, thanks to continued protests from the financial industry. The most recent—and...