Despite the fact that only a paltry 38,000 jobs were added to U.S. payrolls in May and that the current U.S. economy continues to show signs of not being able to support an interest rate hike at this time, Fed Chair Janet Yellen today signaled that we may still...

It's been a particularly bad start to the first full week of 2015 on Wall Street, at the major indexes were pummeled Monday in the wake of further drops in oil prices.

The Dow Jones Average was down 331 points—nearly a full 2 percent—as oil continued its freefall, falling more...

U.S. stocks finished relatively flat on Monday as investors faced the one-two punch of uncertainty in the weather forecast and in overseas markets.

The big story on Wall Street Monday was the impending blizzard scheduled to hit New York City overnight. As of this afternoon, Wall Street hoped to open...

U.S. stocks were higher Thursday, as investors reacted to the retail sales and jobless claims numbers.

Both reports were largely in line with expectations—retail sales for May were up 1.2 percent, as opposed to the expected 1.1 percent. Jobless claims fell within 2,000 of their expected total (279,000 actual vs....

The Consumer Sentiment Index is measured each month by The University of Michigan, and rates the optimism consumers have on the U.S. Economy. For the month of September, consumer sentiment came in at 85.7, well below the expectations of 91.2.

Oil prices dropped more than 3.5% in the morning following...

Following a big day on Wall St. on Thursday, the markets fought to maintain gains made in the early part of Friday's session and eventually closed higher for the third week in a row. Health care and consumer goods led the S&P 500 while industrials declined the most. Corporate...

The last trading day of the week on Wall Street saw gains across the board as retail stocks rose. The major averages ended the week with gains of more than 3% as the S&P 500 finished with its best week of the year. Thoughts about what the Fed may...

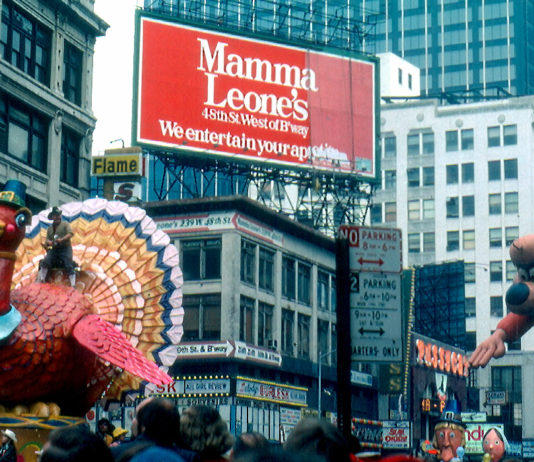

Stocks finished mixed over a bevy of economic reports on the last full trading day before the Thanksgiving holiday. The market is closed on Thursday and will close at 1pm on Friday. Following up & down earnings results from retailers, analysts are watching for indications on consumer spending especially...

On the first trading day of the week came a report from investment banking giant Morgan-Stanley that it has increased it's probability that a recession will hit the global economy within the next year from 20 percent to 30 percent. Read more from CNBC here.

Among Morgan-Stanley's list of chief...

Stock futures were flat Wednesday morning after comments from Federal Reserve Chair Janet Yellen pushed the Dow and S%P 500 to new record highs on Tuesday.

Yellen’s comments in front of the Senate Committee on Banking, Housing and Urban Affairs left investors with the impression that the Central Bank is...