U.S. stocks were mixed on Wednesday, as investors and experts looked towards data points for an indication of when to expect an interest rate hike.

For weeks, Wall Street’s conventional wisdom has held that the first interest rate hike in nearly a decade will occur in 2015—but not likely before...

U.S. stocks were slightly lower Tuesday, as stocks dropped following a worldwide drop in bond prices.

At the start of Tuesday, 10-year benchmark Treasury notes had yields upwards of 2.3% for the first time in almost six months, reaching by far their highest point in 2015. European indices were lower...

U.S. stocks were higher on Thursday, as the markets rebounded from their first-three day losing streak since March.

Disappointing retails sales figures pushed the markets lower yesterday, and today the focus changed to weekly jobless claims data and the producer price index, which expert hoped would shed light on inflation.

Jobless...

For yet another week, the markets remained fixated on interest rates. Stocks moved down on Wednesday when the Federal Reserve all but confirmed that a rate hike is forthcoming sometime this year. However, comments from Chairperson Janet Yellen revealed little about the timing of that rate hike. As a...

Today President Donald Trump followed through on another one of his campaign promises by signing an Executive Order designed to reduce the number government regulations and help American businesses. By signing the order Trump commands all federal agencies (starting in 2018) to create "regulatory reform" task forces which will evaluate...

It's widely known that Wells Fargo is a big bank. How big? With over $1.9 trillion dollars in assets, Wells Fargo has 8,600 stores and offices in all 50 states and over 13,000 ATMs. It has more stores and serves more communities than any other U.S. bank. At the...

The stock market ended the first quarter of 2015 in almost the same position where it began the year. But it sure was a bumpy ride to get back to the starting position.

The Dow took a beating in January—falling almost 4%—before recovering to gain 5.6% in February. This was...

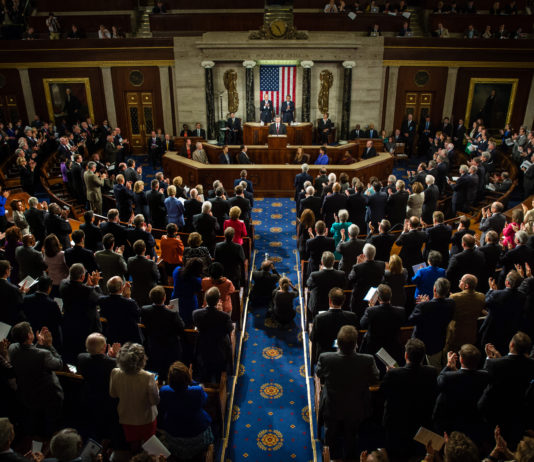

This morning, the Senate will hold a hearing on the topic of regulatory capture—a term used to describe the often-observed tendency of government officials to become a little too close to the institutions they’re supposed to be regulating.

The impending case made yesterday’s announcement from the Federal Reserve all the...

On the first trading day of September some discouraging news on manufacturing in the U.S. led to some nervous movements by investors. The ISM (Institute for Supply Management) manufacturing survey fell to 49.4 in August when it was expected at 52. Any reading below 50 is a sign of...

In less than two weeks on the job, the 114th United States Congress has taken major steps towards undoing one of the most important pieces of financial legislation this decade.

Rep. Mike Fitzpatrick (R-PA) is a member of the House Financial Services Committee. Last week, Rep. Fitzpatrick introduced a bill...