When preparing for retirement it is essential that investors transitioning into the retirement phase of their lives have a financial plan in place to ensure that their assets are protected and are not outlived. One of these preparations includes the process of taking required minimum distributions from a traditional IRA or 401(k) after reaching age 72. In essence, a required minimum distribution is defined as a yearly withdrawal that must be taken from retirement accounts — such as a traditional IRA — as mandated by the Internal Revenue Service (IRS). Not following these distribution rules would result in significant fines or penalties that are associated with the value of the assets in the eligible account or accounts.

Traditional IRA and 401(k) retirement accounts are required to have a portion of the funds withdrawn on a yearly basis because they are funded with income that has not been taxed. Although the money invested in these accounts grows tax-deferred, when the owner reaches age 72, they must begin taking their required minimum distributions. Depending on what the IRA or 401(k) is invested in, or if the account owner has eligible funds to continue contributing to their accounts, an IRA or 401(k) may continue to grow while taking withdrawals each year. Roth accounts are not required to take these distributions because taxes were already paid on the income that funded the accounts — thus Roth accounts grow tax-deferred with after-tax money.

Prior to the SECURE Act going into effect in 2020, the required minimum distribution age was 70 ½ years old; however, the legislation raised the age for new retirees to 72. Individuals who were already taking distributions from their eligible retirement accounts were not impacted by the age increase. Furthermore, individuals who invested in a Roth IRA or Roth 401(k) account were also not impacted by the changes set forth in the SECURE Act, since required minimum distributions are not mandated for those types of retirement accounts. Effective January 1, 2022, the distribution factors used to calculate required minimum distributions for traditional IRA and 401(k) accounts will be updated and impact all eligible account owners.

Required minimum distributions are calculated using one of three life expectancy tables, depending on the status of the individual receiving the distributions. First, there is the Single Life Expectancy Table which is used by designated beneficiaries who inherited an IRA or 401(k) before 2020 and are stretching the inherited account using their own life expectancy. The SECURE Act put an end to the “Stretch IRA” which allowed an inheritor to take distributions over the course of their lifetime and instead replaced that with a 10-year rule mandating that all funds be withdrawn from the account while also paying taxes on the inherited money. Most IRA owners will use the Uniform Lifetime Table unless the sole beneficiary of the account is a spouse who is more than 10 years younger than the account owner — in which case the Joint Life Expectancy Table would be implemented.

In 2018, former President Trump issued an executive order instructing the IRS to update the life expectancy tables to reflect longer lifespans among Americans living in retirement. As of November 2020, the IRS released their official updates to the life expectancy tables which are set to go into effect starting in January of 2022. This means that all required minimum distributions after December 2021 must be calculated using the new tables and as a result, yearly distributions will be moderately reduced across the board. The following are examples of the changes being made to the life expectancy tables and how that will impact IRA owners and beneficiaries.

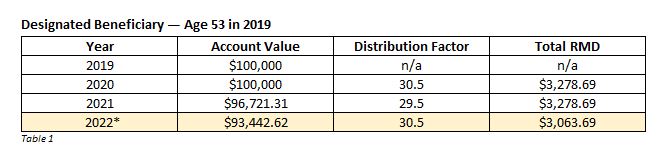

A designated beneficiary who inherited an IRA prior to 2020 would have the option to stretch the account over the course of their lifetime using the Single Life Expectancy Table; beneficiaries who inherit an IRA after 2020 must withdraw all the funds from the account within 10 years following the year of death of the account owner. In the case of stretching the IRA, however, if a designated beneficiary received an account at age 53 in 2019, they would start taking their yearly withdrawals in 2020 — one year after the death of the owner.

RMD = IRA Balance ➗Distribution Factor (Life Expectancy)

In table 1 below, the beneficiary would be 54 years old and under the current Single Life Expectancy Table, they would calculate their distribution using a factor of 30.5 years. In 2020, and in each of the following years, that factor would be reduced by 1 until the funds were depleted or the beneficiary passed; therefore, the distribution factor for 2020 would be 29.5 years for this designated beneficiary.

When the new tables go into effect in January of 2022, the beneficiary will have to find the original age that they began receiving distributions. In this example, at 54 years old the new Single Life Expectancy Table would have been calculated using a distribution factor of 32.5 years. Since the beneficiary would be 56 in 2022, they would subtract 1 for each year that they have taken a withdrawal until they reach their current age, which would result in a distribution factor of 30.5 years to calculate their 2022 distribution.

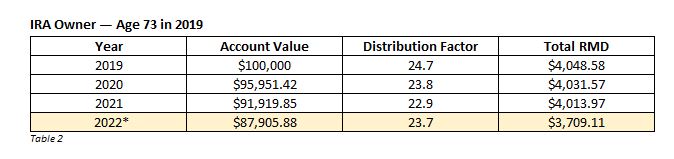

The Uniform Lifetime Table is for IRA owners taking distributions after reaching age 72, or IRA owners who were taking distributions prior to the 2020 age increase. An IRA owner who was 73 in 2019 and already taking distributions would have calculated their withdrawal using a factor of 24.7 years (Table 2). At 74 in 2020, that distribution factor would have reduced to 23.8 years and again to 22.9 years in 2021 at age 75.

When this owner turns 76 in 2022, their calculations will switch to the new Uniform Lifetime Table and use a distribution factor of 23.7 years (instead of 22.0 years) indicating a reduction in their overall required minimum distribution for the year. Compared to the previous table their withdrawal would be increased by a factor of 1.7 years, which would indicate a reduction in the total cash distribution when switching to the new table.

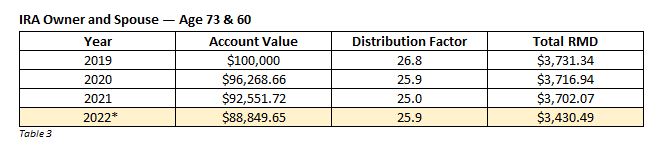

The third and final distribution table used by IRA owners is the Joint and Last Survivor Expectancy Table and is used only if their spouse beneficiary is more than 10 years younger than the IRA owner. If the owner of an IRA were 73 years old in 2019 and their spouse was 60 years old (Table 3) they would use a joint distribution factor of 26.8 years. In 2020 that factor would be reduced to 25.9 years when the IRA owner turned 74 and their spouse 61. The following year in 2021, when the IRA owner turns 75 and their spouse 62, they would use a distribution factor of 25 years.

Just like the other life expectancy tables, when the calendar changes to 2022 the new tables will go into effect, and a new joint distribution factor will be used to calculate their required withdrawals. When this IRA owner turns 76 and their spouse 63, the distribution will be 25.9 years according to updates made by the IRS. As a result, their required withdrawal for the year would be reduced by a factor of 1.8 years compared to what would have been their distribution if they had used the previous life expectancy table.

Although these changes are set to go into effect in 2022, it is imperative to prepare for these changes by meeting with a licensed retirement phase expert to ensure that you are taking the correct amount of money for your yearly required minimum distributions. By taking more than the required amount from a traditional IRA or 401(k) you could be on the hook to pay more in taxes. To avoid this, a licensed retirement phase expert can assist you in staying up-to-date with the newest regulation in the continually changing IRA investing environment and help you maintain peace of mind throughout retirement.