U.S. stocks finished flat on Wednesday, as investors continued to show growing concern over global growth.

A topsy-turvy day saw the Dow drop 277 points in morning trading, before an afternoon rally returned the index to its starting point. The Chinese yuan declined yet again, as the People’s Bank of China...

Monday marked a great start to the trading week for all three major U.S. stock indices. The Dow, S&P 500 & NASDAQ each closed at all-time record highs. Why and what does it mean? See more from CNBC's Bob Pisani below.

Meantime, one giant in the hedge fund industry-David Tepper...

As the U.S. stock market opened Tuesday trying to avoid another day in the red, a new obstacle appeared overseas.

The Russian ruble continued to tumble Tuesday morning, following its worst session in 15 years Monday. Even a late-night action by the Central Bank of Russia (CBR) to raise interest...

A surge in the energy sector pushed stocks higher Thursday, while investors considered the weekly jobless claims report.

The report released this morning showed 281,000 jobless claims, in line with expectations but slightly higher than last week’s figure of 268,000. This was the first report since Friday’s disappointing jobs figure...

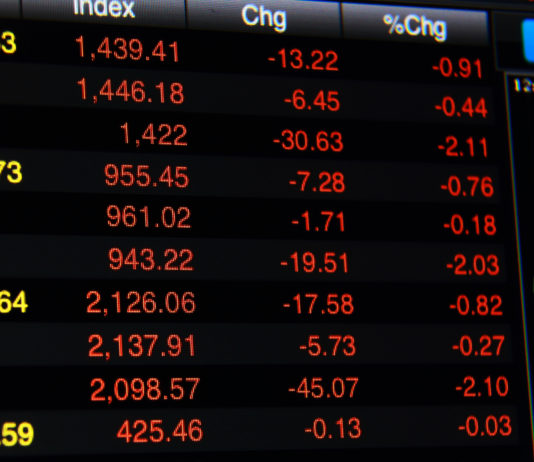

U.S. stocks were clobbered on Friday, as a double dose of bad news from overseas sent markets tumbling before the weekend.

The sell-off was a continuation of a global trend Friday, as European and Asian markets suffered as well. Chinese government regulators took steps to crack down on margin trading...

After a long holiday weekend, Wall Street began the new trading week with investors eagerly awaiting the latest jobs report this week. Even though the market finished mix today, new figures released from the CNBC/Moody's Analytics Report showed 1st quarter-2016 economic growth was just 0.9 percent. The numbers translated...

Experts described the U.S. stock market as ‘under pressure’ Friday morning, coming off a fifth consecutive losing session Thursday.

The Swiss National Bank shocked everyone Thursday by announcing they would discontinue a three-year cap on their own currency—the Swiss franc—against the Euro. With the possibility of quantitative easing-type programs beginning...

U.S. stocks dropped sharply Wednesday afternoon, following an optimistic morning report from both Apple and Boeing in their 4th-quarter earnings results.

Investors were buoyed by the results, which showed that Apple sold almost 9 million more iPhones than expected. German-listed shares of Apple were up 6 percent in trading Wednesday...

U.S. stocks were slightly higher on Tuesday, as investors moved their attention away from Greece and back to information on the U.S. economy.

Today’s biggest piece of data—retail sales—proved disappointing, as June figures showed a decline of 0.3 percent. Experts and analysts had been expecting an increase of 0.3 percent.

Treasury...

It was a mixed day on Wall Street but perhaps more alarming was a report by world renowned French bank- Societe Generale. The bank released its quarterly report that included concerns about the possibility of so-called "black swan" events that could harshly disrupt global economies.

“Risks to the world economy...