On the surface, foreign currency trading looked like an ideal post-recession activity for “Too Big To Fail” banks.

The exchanges offered the possibility of considerable returns on investment, coupled with a low risk environment. Those two factors made the exchange market the perfect business venture for an industry reeling from...

Even with troop reductions in Iraq and Afghanistan, the unrest in the Middle East continues to affect the United States’ economy on an almost-daily basis.

Last week, markets opened lower on Monday morning due chiefly to concerns over escalating tensions in Iraq, where Sunni insurgents began campaigns to overtake regions...

In theory, the price of shares across the stock market is a reflection of economic health. If stocks are up, business is thriving— or so we thought…

Recent market volatility is showing some tell-tale signs that it is not grounded by a sturdy economy, which leaves the fear that it...

Phil Cannella interviews former Federal Reserve finance manager, Andrew Huszar, on why he, after becoming an integral part of the creation of Quantitative Easing, wrote an Op-Ed in The Wall Street Journal that began with the words, "I can only say: I'm sorry, America."

Andrew Huszar is a Senior Fellow...

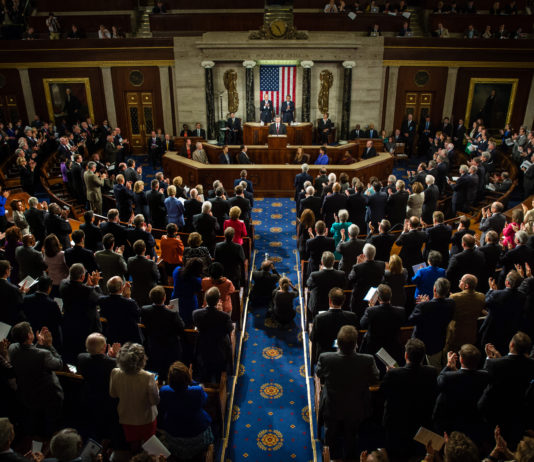

This morning, the Senate will hold a hearing on the topic of regulatory capture—a term used to describe the often-observed tendency of government officials to become a little too close to the institutions they’re supposed to be regulating.

The impending case made yesterday’s announcement from the Federal Reserve all the...

In less than two weeks on the job, the 114th United States Congress has taken major steps towards undoing one of the most important pieces of financial legislation this decade.

Rep. Mike Fitzpatrick (R-PA) is a member of the House Financial Services Committee. Last week, Rep. Fitzpatrick introduced a bill...

The crisis in Russia worsened Tuesday when Standard and Poor’s (S&P) placed the nation on negative credit watch.

In a statement, S&P said that the move “stems from what we view as a rapid deterioration of Russia’s monetary flexibility and the impact of the weakening economy on its financial system.”

The...

The stock market ended the first quarter of 2015 in almost the same position where it began the year. But it sure was a bumpy ride to get back to the starting position.

The Dow took a beating in January—falling almost 4%—before recovering to gain 5.6% in February. This was...

The question, is there a retirement crisis in America, was answered earlier this month during an expert panel discussion moderated by the Founder of Retirement Media Inc., Phil Cannella. This eye-opening conversation took place just outside of Philadelphia at the Retirement Media Inc. production studios and featured some of...

This week, France set a precedent for governments around the globe when it approved a new law that will levy a 75% tax on French companies that are paying employees €1 million or more in annual salaries. The new tax is widely understood to be symbolic, as a message...